Look into carpooling with friends or coworkers. But in other cities, a car truly is a necessity.

Some cities are easy to live in without a car, thanks to good public transportation and bike paths. That leaves only $124 for a car payment, parking and other transportation expenses. You'd need to budget about $87 per month with prices at $2 per gallon. For maintenance and repairs, you should budget at least $500 a year, or $42 a month - maybe more if you're buying an older car.įor gas, let's assume you drive 1,000 miles a month and your car averages 23 miles per gallon. So before you rush out after graduation to buy your first set of wheels, make sure you are aware of the real cost of buying a car. But if you have a car loan, I don't know many people who pay less than $211 to begin with, let alone the money they spend on gas, parking, maintenance and repairs. If you own your car outright, $211 a month for transportation is a good estimate - perhaps even too high. Possible adjustmentsĪ couple areas you'll want to watch out for include the transportation and debt repayment categories. And if you live with a roommate, you may be able to share the cost of your utilities, cable and Web access, giving you even more leeway in your budget.įor help keeping track of your expenses, use Kiplinger's Budget Worksheet (opens in new tab). We had budgeted $211, so that leaves you a $24 cushion for those months in which costs may vary.

BREAKDOWN OF MONTHLY EXPENSES PLUS

Now let's add 'em all up: $50 for utilities, $17 for renter's insurance, $70 for cable and Internet plus $50 for your cell phone, and you're looking at $187 a month. If that's too conservative, you may have to look for other areas to cut back. If that's too steep for your budget, consider using a prepaid cell phone that charges you only for the minutes you use. But the average cell phone bill in the U.S. (A bare-boned landline service typically costs about $20 to $25 a month.) Cell phone bills can vary widely by location, provider and, of course, your own personal use. You might save money on your phone bill by scrapping your land line altogether and sticking to your cell phone. Add a high-speed Internet connection for $40, and you'd do well to budget $70 or so for the whole package. The national average cost for basic cable is about $15 a month - $30 for expanded basic, to which the vast majority of cable watchers subscribe.

You can usually get a cut-rate deal for bundling services together.

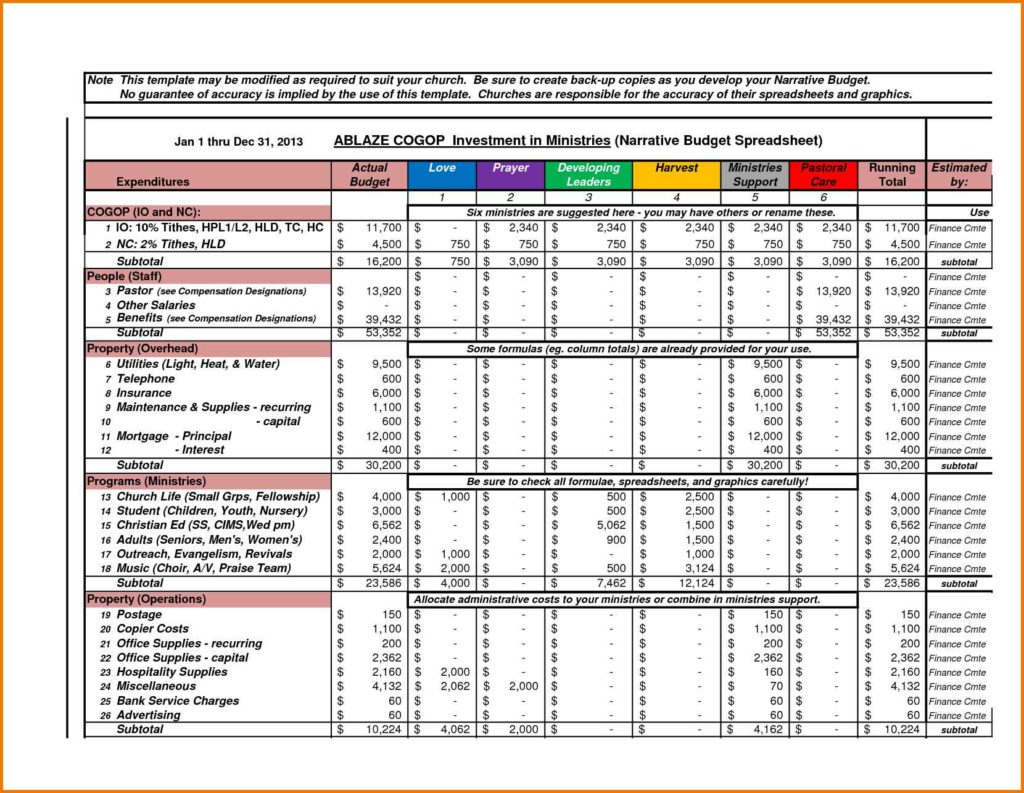

But if that's too drastic for your lifestyle, consider getting high-speed service through your cable-TV provider. You can find service for about $10 a month. You can save money on your Internet service by going back to the stone age of dial-up. And many apartments come with garbage and water service included, so you may not have to worry about that.įor renter's insurance, a good policy can run about $200 a year - or $17 a month. But budgeting an average of $50 to $60 per month to power a one- or two-bedroom apartment should suffice. If you live in Las Vegas, for example, you'll spend a lot more on air conditioning this summer than someone in Minneapolis. Your actual cost will vary by your location, season and how well-insulated your apartment is. We start with utilities, such as gas and electric. We'll get to that topic later, but for now let's take a closer look at the utilities and household expenses category. Debt repayment is another wild card for which you may have to make adjustments. Housing, of course, will vary depending on your location and also on whether you live alone or with roommates (opens in new tab). In terms of dollar figures, this actually breaks down pretty close to the lines of what things will actually cost you. 10% ($211) Utilities and other housing expenditures (including renters insurance)ġ0% ($211) Transportation (including car loan (opens in new tab))ġ0% ($211) Debt repayment (opens in new tab) (student loans and credit cards)ĥ% ($106) Entertainment (opens in new tab)ĥ% ($106) Car insurance (opens in new tab) and miscellaneous personal expenses

0 kommentar(er)

0 kommentar(er)